Blog

What is the Voluntary Carbon Market and How Does it Work?

4 June 2025

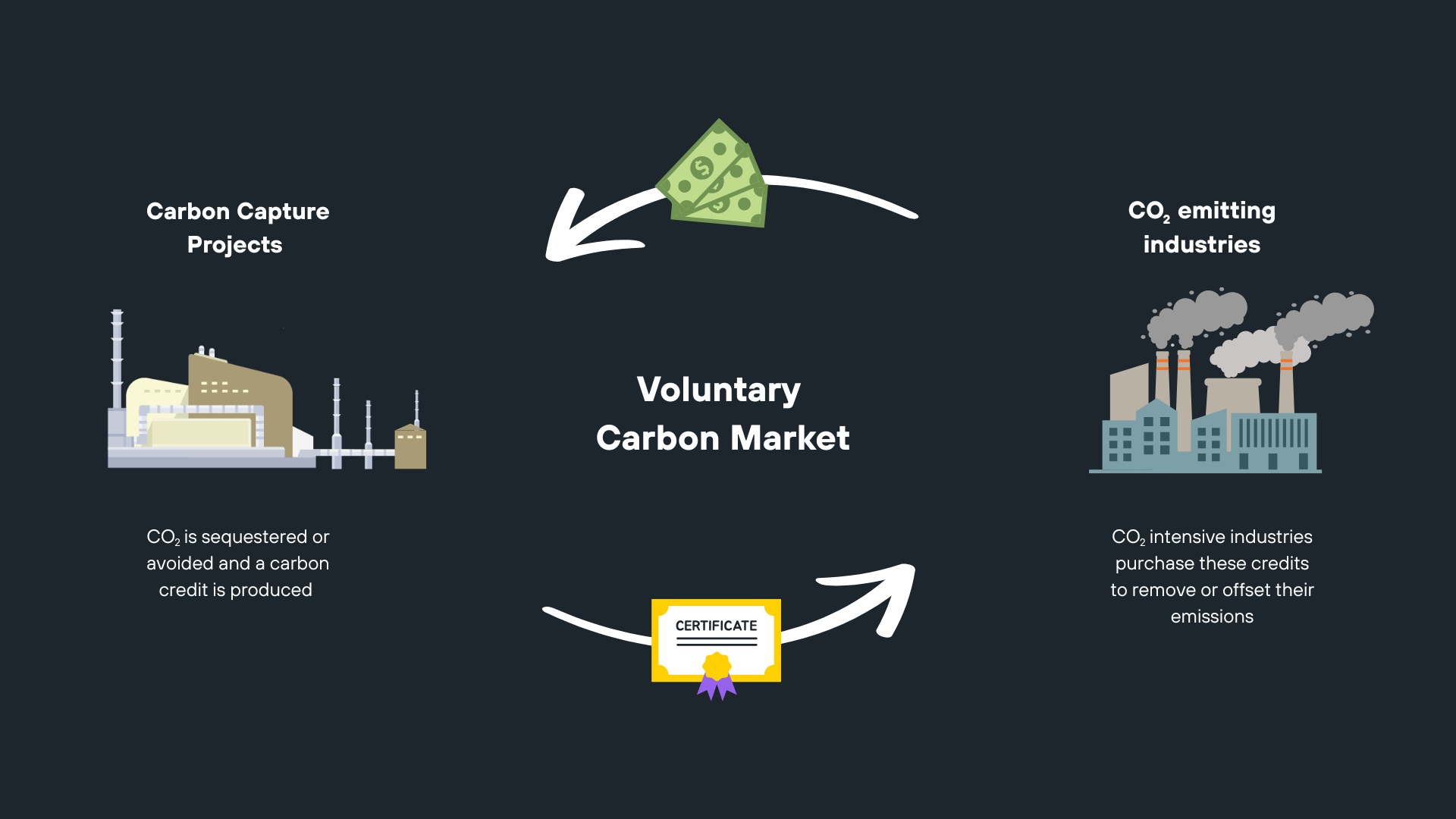

In the face of growing concerns about climate change, many companies and individuals are looking for ways to reduce their environmental impact. One solution that has gained significant traction is the voluntary carbon market (VCM) – a system that allows participants to offset their greenhouse gas emissions by purchasing carbon credits. But what exactly does that mean, and how does it work?

The Basics

The VCM is a marketplace where companies, organisations, and even individuals can purchase carbon credits to offset their emissions voluntarily, meaning they are not required by law to do so.

Each carbon credit typically represents one metric ton of carbon dioxide (CO₂) – or its equivalent in other greenhouse gases – that has been removed from the atmosphere or prevented from being emitted in the first place.

These credits can be in the form of both carbon offsets and carbon removals – both of which result in a credit, but distinctly differ in their quality, durability and methodology.

How It Works

- A project is created – This could be a renewable energy project, such as Evero’s BECCS projects, reforestation effort, methane capture initiative, or another type of verified emission reduction activity.

- Carbon credits are generated – Based on how much CO₂ the project avoids or removes, it earns a number of carbon credits. These credits are verified by third-party organisations to ensure the impact is real and measurable.

- Credits are sold on the market – Companies or individuals buy these credits to compensate for their emissions. For example, a business might not be able to eliminate all of its emissions right away, so it buys credits to "balance out" the difference. Credit prices vary depending on their quality and the market. Credits can also be traded between companies once they are purchased.

- Credits are retired – Once a credit is used to avoid emissions, it’s retired, meaning it can’t be sold or used again.

Why Use the Voluntary Carbon Market?

The VCM allows organisations to take climate action beyond what is required by regulation. It’s often used to meet sustainability goals, respond to consumer demand for environmental responsibility, or prepare for future regulatory changes. For example, big tech companies are quickly becoming some of the largest buyers on the VCM. For individuals, it’s a way to offset the impact of things like flights or daily carbon footprints.

It also plays a key role in funding climate solutions. Many carbon offset projects rely on the revenue from credit sales to operate, especially in developing countries. In this way, the voluntary carbon market helps channel private finance into environmental and social initiatives.

How big is the Voluntary Carbon Market?

Whilst the voluntary carbon market is relatively new, it’s evolving fast. Carbon capture and Storage (CCS) was listed as the most up-and-coming project type producing carbon credits, with CCS issuances increasing sixfold in 2024 to 212,101 units, from 36,000 in 2023.

Projects like Evero’s BECCS programme will contribute up to 600,000 high-quality credits to the market each year, representing more than 600,000 tonnes of carbon dioxide captured annually and sequestered underground.

How does the Voluntary Carbon Market differ from the Compliance Market?

The Compliance Market is sets of national or international carbon reduction regimes (e.g. The UK ETS). These markets work under a cap-and-trade system where companies are allocated a set number of emissions allowances.

Unlike the VCM and carbon credits, the Compliance Market is mandatory for specific industries, and you can’t create or remove allowances, but they can be traded.

The Future of the VCM

Efforts are underway to continually ensure that credits represent real and lasting benefits. As climate commitments grow, the VCM will play a crucial role in bridging the gap between current emissions and net zero goals, with engineered removals playing the largest role in reducing combined emissions to zero according to the 7th Carbon Budget.

As climate commitments grow, the Voluntary Carbon Market will play a crucial role in bridging the gap between current emissions and net zero goals.